How to Help Cardholders Understand Their Spending at a Glance

Empower cardholders with more accurate transaction information

Are these familiar scenarios?

Your cardholder reviews their recent statement, and notices charges from companies that aren’t recognizable and aren’t local. Are these fraudulent? Or simply corporate names and locations for familiar retail stores? How is your cardholder supposed to tell the difference?

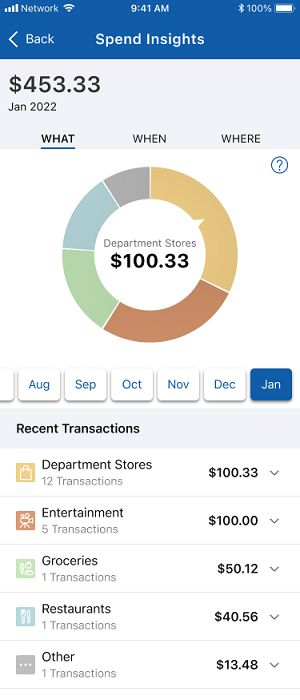

Another cardholder wants to know what they are spending, wondering “What did I spend this month on groceries? On restaurants? Online?” How can they effortlessly see this information in their account?

Today’s consumers are digital – and they are actively seeking out online, customized self-service experiences to see and understand their financial data. With consumers using cards more than ever, providing access to detailed debit and credit card transaction information enables them to get their questions answered and use their cards more confidently.

Financial institutions can help meet these expectations by using AI, banking data and digital delivery to push detailed and personalized information regarding fraud detection, risk assessment, money management, and rewards and offers directly to cardholders.

Providing consumers with instant online and mobile access to detailed transaction insights and enriched information will make it easier for them to understand their purchasing patterns, help them make timely and informed spending decisions, and ease their minds about what may first appear to be fraudulent transactions on their statements.

Consumers want to understand their spending patterns and specific purchase details.

The Challenge

Financial institutions face a major challenge when attempting to provide consumers with the custom information they want. That’s because the data financial institutions typically receive and provide often contains incomplete, extraneous or even misleading information that is difficult for consumers to quickly and accurately decipher. A few examples:

Ambiguous merchant names. A merchant may have many different names, and some may include a store number, carry a serial number or have soft billing descriptors.

Fragmented merchant names. A merchant may use abbreviations or concatenated text to try to fit as much information as possible into the limited space provided by the ISO transaction standard format. This often leads to some merchant names being cut off due to the character space limit.

Incorrect merchant locations. A merchant terminal is often programmed with the location of its headquarters or regional office. When this occurs, a shipping terminal in California, for example, may have “Memphis, TN” as the location, and a vending machine in Florida may carry “Tukwila, WA” as its location.

Incorrect transaction categories. A merchant may use an outdated merchant category code, or a payment provider may send its own category code in the transaction. For example, a transportation transaction paid through a non-financial institution provider may carry a general money transfer category code rather than a more accurate travel category code.

Less-than-optimal data quality in a bill or statement doesn’t just affect the delivery of personalized and meaningful insights; it can also cause considerable consumer confusion. And that often results in more transaction disputes and customer service calls. Both of these create unnecessary consumer tension and can needlessly strain your servicing resources.

The solution

Providers of open banking and personal financial management solutions have used labeling and rules engines to resolve some of these data quality issues. Typically, this involves retrieving limited data through screen scraping, which usually only contains names, transaction amounts and dates. This method has limited precision and recall, and is hard to scale.

Alternatively, financial institutions and their processing providers can take on this data challenge by balancing the unique interplay between real-time transaction authorization, user context, merchant databases and AI. These elements can work together to provide the information consumers want. It’s highly technical, of course, but it can produce results that are uncannily accurate.

Financial processors see all the data elements in the authorization stream that are often abstracted away or not preserved in offline databases

In real-time, when an authorization occurs, the transaction and merchant can be correlated with user locations where available

Mobile users who have enabled their location can help crowd-source the enrichment of merchant data for other card-present transactions without locations

Natural language processing can be used to recognize and understand merchant name entities from the transaction descriptions

Semantic searches leverage the state-of-the-art word and sentence embeddings learned from merchant databases to search for the best possible match

A deep-neural-network-based computer vision model is trained with these learnings and fine-tuned with merchant logo databases and text detection

Clustering is used to identify the most likely store location

A time-series detects the cycles of transactions and, therefore, recurring payments and merchants

Machine learning classification models classify transaction types (in-store, eCommerce, mail order/telephone order) and merchant categories (restaurants, groceries, transportation, clothing and so on) based on the wealth of data fields available from the real-time authorization stream, such as POS entry mode, condition code, terminal type and merchant category code.

This can be used to build deep-and-wide machine learning models to produce results that yield significant transaction data enrichment. This process should cover merchant names and categories, store locations, payment channels, payment methods, digital wallet type, card on file, recurring payments and many other attributes, thereby resolving the hidden errors in names, locations and categories in real time.

A better consumer experience

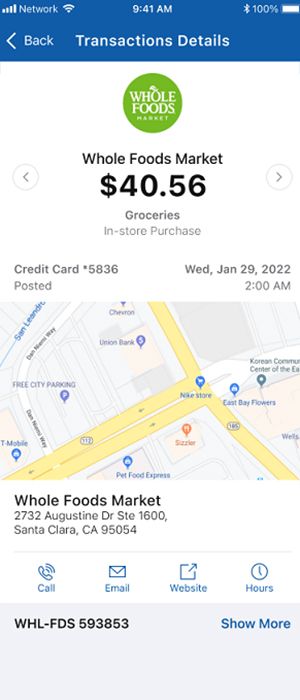

By using AI to interpret data already in the authorization stream, your financial institution can delight your debit and credit cardholders and help relieve the tension associated with potential fraud. Enriched transaction information can mean the difference between a panicked consumer who is worried about potential fraud and someone who is secure knowing that each purchase is one they have made.

The transaction information you provide should include real merchant names, actual retail locations for physical purchases, transaction amount and purchase date.

The more transaction information provided, the better. Transaction details should also include contact information for the merchant so consumers have the ability to make any inquiries about the purchase directly.

A better financial institution experience

The peace of mind you’re providing to cardholders can be enhanced by using the enriched transaction data and purchasing patterns you’ve collected to deliver personalized offers. Does your cardholder show a pattern of coffee shop visits or retail clothing purchases? Do they make in-store purchases or shop online? Are they frequent airline travelers and hotel guests?

When you recognize – and incent – their spending choices, you are letting them see that you know them. You not only make them feel safe but also drive their engagement with your institution.

Everyone wins

Using this approach offers significant benefits in reducing cardholder disputes and customer service calls, preventing fraud, deriving accurate spending insights for consumers and personalizing offers based on a consumer’s profile. Everyone wins.

Explore related resources